What should I keep in mind before making a withdrawal request?

-

As we may sometimes need to contact you about your withdrawals we encourage you to closely monitor your email inbox (including your junk folder).

-

Whenever you request a withdrawal, you should bear in mind that a withdrawal could trigger a margin closeout if you no longer have sufficient funds on your account to maintain your open positions.

-

Withdrawals are subject to our hierarchy rule. If you have deposited using multiple methods, you must exhaust the total original deposit amounts in the following order:

-

Credit/debit card

-

Neteller

-

Skrill

-

Bank or wire transfer

-

-

Any money standing to the credit of your landing account(s) (which excludes any bonuses or trading credits) will be transferred to you upon request, subject to you satisfying relevant margin requirements and documentation requests. Also, there must be no outstanding sum due from you.

-

Withdrawals from your landing account(s) should be made to the same source/account you used to fund your account. If you have sent funds to us from more than one bank account, we will, at our discretion, pay any amounts withdrawn from your landing account(s) to one of the bank accounts from which such funds were received.

-

Where applicable we will return money to your credit/debit card in the form of card refunds. This means that your withdrawal request may be split into multiple payments in order to refund each of your individual deposit transactions.

-

Withdrawal requests for more than US$9000 will be restricted if you have not provided the required documentation.

The total amount you can withdraw to your credit/debit card(s) cannot be more than the total amount you deposited from those cards. Any funds remaining in your account after you have withdrawn the full amount you originally deposited by credit/debit card (e.g. trading profits) may instead be withdrawn by bank or wire transfer.

When will I get my money?

One to three business days. We do our best to process your request as quickly as possible, but please consider the following may also impact processing times:

- Withdrawals to credit/debit cards are only processed after all your credit/debit card deposits have cleared. This on average takes around 1 business days from the date of your deposit

- Your debit/credit card provider may take additional time to complete your withdrawal.

Withdrawal fees

There are no fees for credit/debit cards.

Withdrawals to the above providers are only processed in HKD, EUR and USD

When will I get my money?

Within one business day

Withdrawal fees

If your e-wallet account is denominated in a currency other than your accounts based currency (for example USD), you may incur exchange fees levied by Neteller in addition to their withdrawal fee.

-

Neteller accounts must be held in the same name and at the same address as in our records for a payment to be successful

-

Neteller members must be fully verified to be able to make a successful payment

-

Neteller corporate payments are not allowed

-

Neteller payments must not originate from a prepaid card.

Withdrawals to the above providers are only processed in HKD, EUR and USD

When will I get my money?

Within one business day

Withdrawal fees

If your e-wallet account is denominated in a currency other than your accounts-based currency (for example USD), you may incur exchange fees levied by Skrill in addition to their withdrawal fee.

-

Skrill accounts must be held in the same name and at the same address as in our records for a payment to be successful

-

Skrill members must be fully verified to be able to make a successful payment

-

Skrill corporate payments are not allowed

-

Skrill payments must not originate from a prepaid card.

Withdrawals by bank or wire transfer must be:

- Processed to bank accounts registered to the same person as the OANDA account holder

- The name and address on your OANDA account must match the name and address on the bank account you would like the withdrawal to be processed to

- Processed to the same country, in the same currency as the original deposit.

-

Your full name

-

The bank account number

-

Your current address (addresses need match what is on file with OANDA)

-

The banks logo or emblem

-

The date of issue which should be within the last 3 months.

When will I get my money?

Within two to five business days

Withdrawal fees

Withdrawals made by bank transfer will incur a fee for each transaction.

The fees are as follows:

| Account currency | Flat fee for each transaction |

|---|---|

| EUR | EUR €20 |

| HKD | HKD $150 |

| USD | USD $20 |

You cannot withdraw funds back to an APM. If you deposited via an APM, you may withdraw back using a bank or wire transfer.

-

To withdraw funds, first log in to the OANDA portal.

-

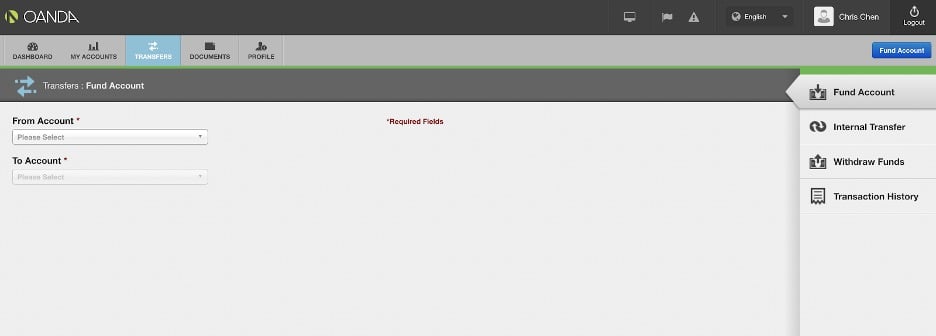

Next, click on Fund Account located in the top right corner of your screen. Alternatively, you can click on TRANSFERS located along the top left of the screen.

-

Once on this page, click on Withdraw Funds located along the right side of the screen.

-

Next, to withdraw funds choose which account you wish to draw funds from by selecting it via the drop-down menu under From Account and selecting where you want those funds to go via the drop-down menu under To Account .

-

Next, select the payment method, select the amount you want to withdraw and then again enter the amount you want to withdraw. Make sure the amount you enter is the same as what you had deposited using the given payment method.

If the payment method that you used to fund your account no longer exists (i.e. bank account profiles that have been closed), you may be eligible to withdraw your funds using bank or wire transfer. In this scenario, we require documentation from your provider verifying that the payment method is no longer operational.

For more information or assistance on this subject, please email frontdesk@.

You can return 100% of your original deposit back to your card.

Any funds remaining in your account after you have withdrawn the full amount originally deposited by a card (i.e. trading profits) may instead be withdrawn via bank transfer.

Still have questions? Chat with an agent.