The Turbulent Twenties

The twenties have been a decade of immense turbulence in financial markets so far. We’ve had a global pandemic, a war in Europe, the return of very high inflation, rapidly rising interest rates, the rise and fall and rise again of crypto, the resurgence of conflicts in the Middle East, and more recently, an explosion of excitement around AI and how it’s going to revolutionize the world in the years to come.

This year will build on all of these stories while delivering the biggest election year in history across the globe. Here are five things that investors will be paying close attention to over the course of 2024.

Will 2024 be the year of falling inflation and interest rates?

The obsession around inflation and, by extension, interest rates looks set to continue in 2024, and for good reason. Of course, investors are always obsessed with what central banks are doing and always have been, but the last four years have created an incredibly uncertain environment for central banks. As a result, interest rate expectations have wildly fluctuated, which has significant implications for asset prices and the economy.

The difference in 2024 is the direction of travel for interest rates compared with the last two years. Inflation has been falling aggressively for many months, even while central banks were still raising interest rates. But now it’s fallen so far in developed economies that central banks will be forced to quickly pivot from tightening to easing.

As is so often the case, markets started the year much more optimistic on interest rates than policymakers did. But what they both appear to have in common, especially as far as the Federal Reserve is concerned, as they publish a dot plot of forecasts for the Fed Funds Rate, is that they believe 2024 will be the year that rates start falling.

Markets ended 2023 in quite exuberant fashion – the Dow, Nasdaq, DAX and CAC all hit record highs late in December - buoyed by a much greater expectation for rate cuts in 2024 while developed economies achieve their goals of a soft landing or, at worst, a very mild recession. This looked very unlikely when central banks were raising rates very aggressively.

AI to deliver another knockout year for the Magnificent Seven?

Things were looking pretty bleak for stock markets early last year, until we saw an explosion of AI excitement that propelled indices higher, led by the Magnificent Seven: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

The exceptional performance of these seven stocks drove the Dow and Nasdaq to record highs before the end of the year, something that looked extremely unlikely at the end of the first quarter. Remember, stocks at the time were under pressure as central banks were raising rates aggressively and no one knew quite how far they would go.

At the end of Q1, the Nasdaq was almost 25% off its highs. By the end of the year, it had rallied more than 32% to reach a new record high; quite the turnaround.

Going into 2024, investors were asking themselves what impact AI would have on stock markets this year. Will benefits be contained in the Magnificent Seven again or shared more broadly? What companies and sectors will benefit most from the adoption of this technology, and how quickly can they show results? Will an improved risk environment, and perhaps multiple rate cuts, fuel further enthusiasm for these stocks? And what about the Magnificent Seven? Was the boom in these stocks in 2023 justified or an unsustainable knee-jerk reaction?

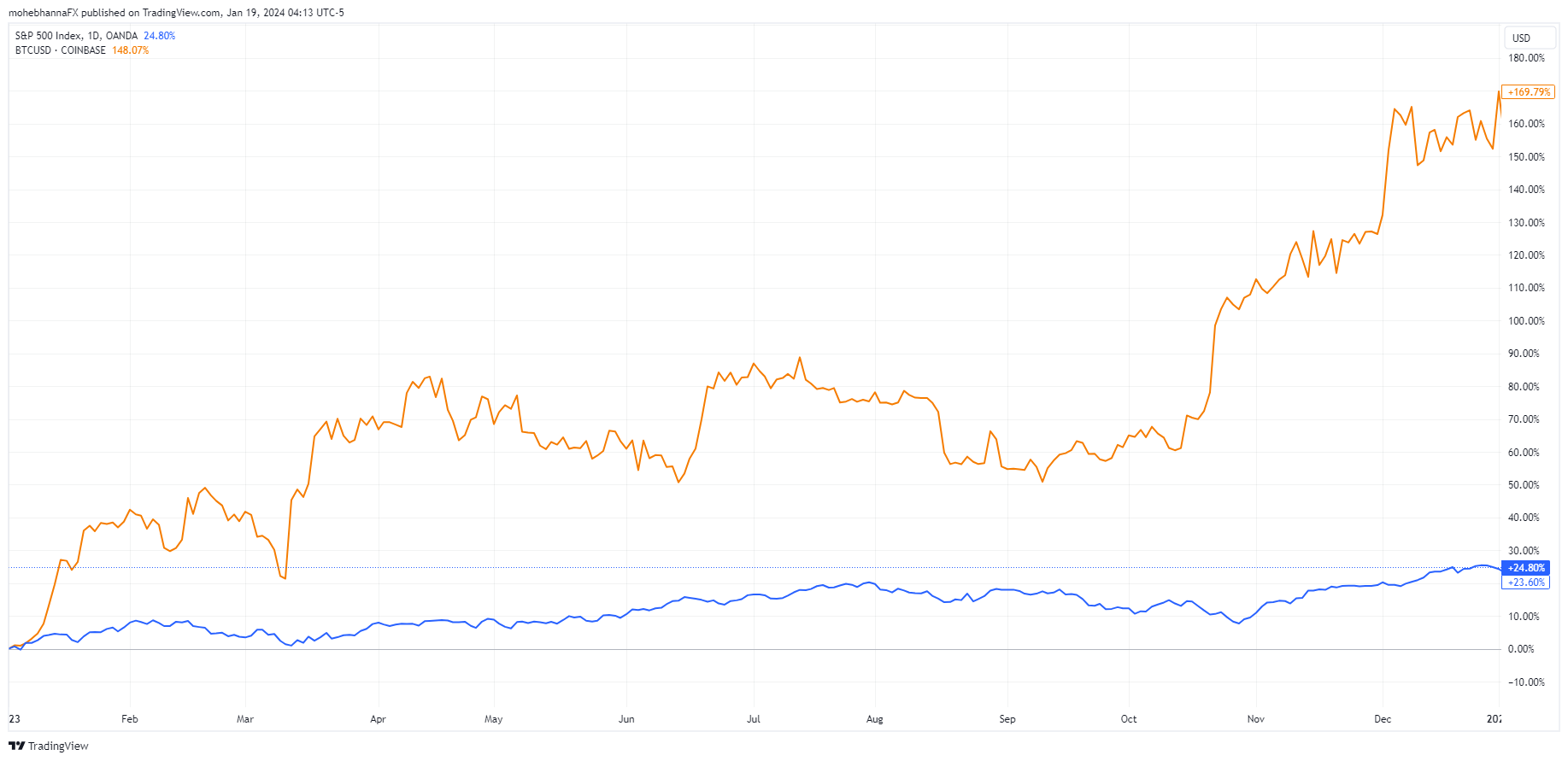

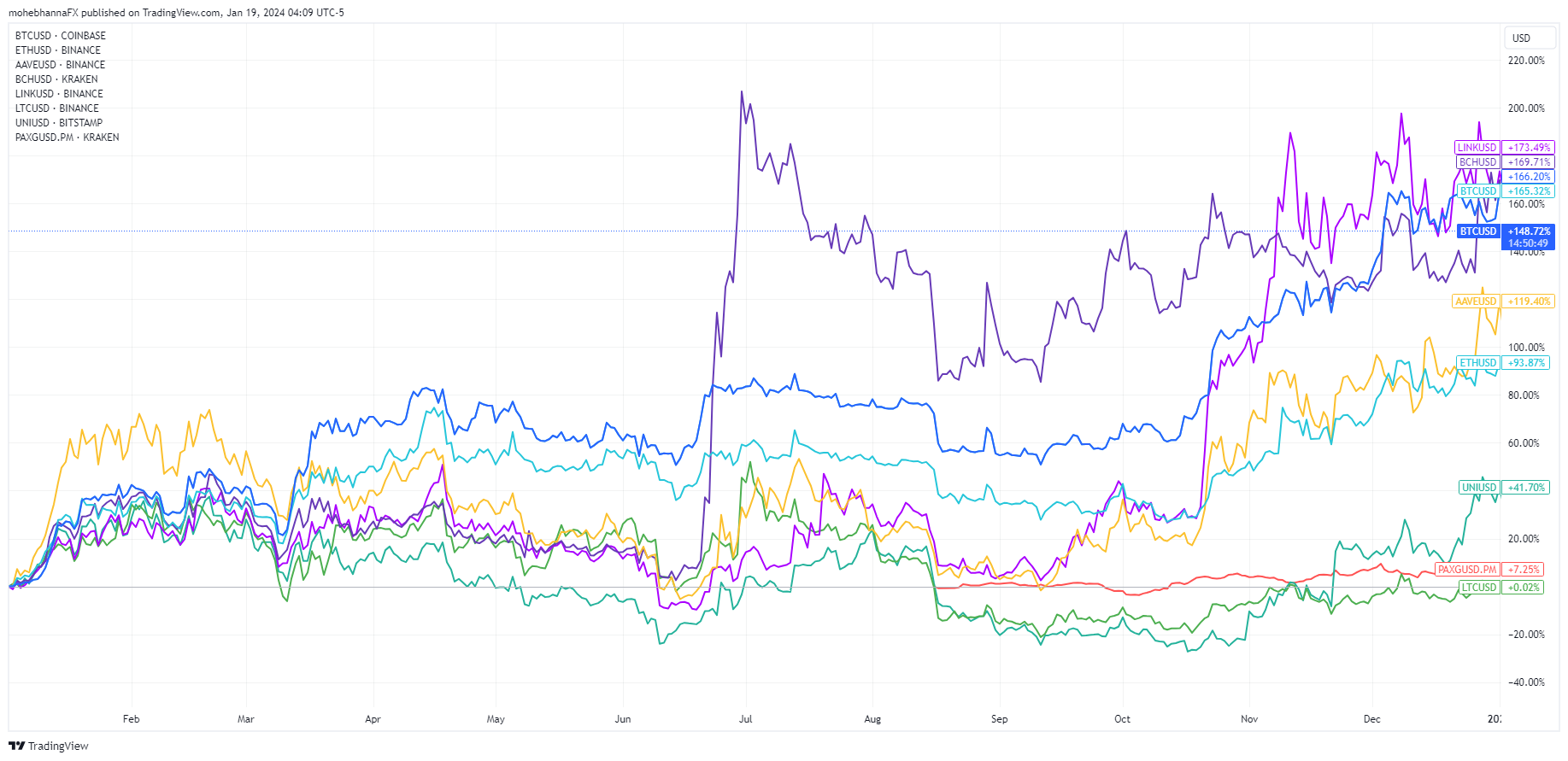

A make-or-break year for bitcoin?

The last couple of years have been extremely challenging for the cryptocurrency space. Rapidly rising interest rates weighed heavily on appetite for risk assets, something cryptos relied heavily on in the run up to their peak in November 2021. Investors suddenly had to be far more selective with allocation and that didn’t bode well for cryptos.

Then there were scandals and regional bank collapses in the US, the environment turned more hostile and it became a question of who would survive rather than thrive. Now it looks like the worst is behind us and it could be argued that the industry is in a stronger position as a result.

But that doesn’t necessarily mean it’s set to thrive once more. Just because investors have more appetite for risk again, does that mean they will pour back into crypto? And if so, which coins? Will the excitement around AI be positive or negative for cryptos? Or have no impact at all? Considering the growth seen in the Magnificent Seven last year, will investors see more value in AI stocks that also offer the potential for extraordinary returns?

And that’s before we get to the spot bitcoin ETF approvals and the halving event, expected to take place in April. Could these prove to be bullish catalysts for cryptos? Or are they priced in? What will be the next focal point for the community after the SEC approved spot bitcoin ETFs in January? The industry relies on excitement around what’s coming next that will drive widespread adoption and speculation.

A return to the White House for Donald Trump?

The US election in November is wide open and could have a significant role to play in how markets perform, particularly later in the year. While neither candidate has been confirmed, President Joe Biden is widely expected to run for a second term, while Donald Trump, who lost the election in 2020, is the odds-on favorite to win the Republican nomination. A repeat of the last election will undoubtedly be a fiery and deeply divisive encounter, especially considering how the last contest ended and Trump’s continued refusal to accept the election result.

Investors will be more interested in how markets are expected to perform after the election and who the better candidate will be for them. Stock markets performed very well for the majority of Trump’s first term, as did the dollar between 2018 and early 2020. From then on, the pandemic, the war in Ukraine, and the inflation spike make it very difficult to judge. Of course, the decision-making of those in charge impacts the outcome, but these are once-in-a lifetime events. Not something that investors will easily be able to make a judgment upon.

We’ll learn more as the year progresses, including who the nominations will be and what their priorities are, not to mention what the likely make-up of Congress will be, as this will determine what the next president will be able to achieve. One thing they will have to contend with is a heavy debt load and, therefore, little fiscal leeway. Not to mention wary lawmakers who will just have spent the best part of three years either dealing with high inflation or complaining about it.

Can the UK Conservative Party hold onto power?

The UK will almost certainly go to the polls in 2024, with autumn being the most likely time, although nothing had been confirmed at the start of the year. You can understand why the ruling Conservative Party would want to delay the election as long as possible, as at the start of the year they were far behind in the polls, with the Labour Party favorites to secure a majority. But it must take place by January 2025 at the latest,making the autumn of 2024 the most likely option.

While the Conservative Party was far behind in the polls at the start of the year, they will likely fluctuate a lot in the months leading up to the election. And as we’ve learned in recent years, the polls aren’t always particularly reliable. Just look at the Brexit polls back in 2016.

The other question investors must ask themselves is how markets may respond depending on the different possible outcomes, including either main party having to go into coalition. One school of thought, for example, is that the next Parliament will have their hands somewhat tied by fiscal restraints, and both main parties have come more into the center in recent years, so spending plans may not be drastically different. Both would, of course, argue otherwise, and time will tell which turns out to be true.

But with so much uncertainty around the economy already, interest rates likely to still be very high come polling day, and inflation above target, the next election may be fought less on giveaways and more on stability and the protection of finances.

Conclusion

Now that you've taken a detailed look at some of the currency pair options to consider as part of your FX strategy, you may want to learn more about trading forex with OANDA.

Disclaimer

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

It is not investment advice or a solution to buy or sell instruments. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation. Digital assets held with Paxos are not protected by SIPC. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations.

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.