What moves the FX markets?

The first thing to note when thinking about FX markets is that you’re not just thinking about a particular currency, say the pound sterling (GBP), you’re thinking about it in relation to another.

So for example, GBP/USD weighs up the strength or weakness of the pound compared to the US dollar.

The reason this is important is that a currency may perform well against most other currencies because the central bank raises interest rates or a particularly good jobs report is released but that doesn’t mean it will be against all of them.

That said, in general, there are a wide range of things that currencies can be sensitive to and some of these are covered below.

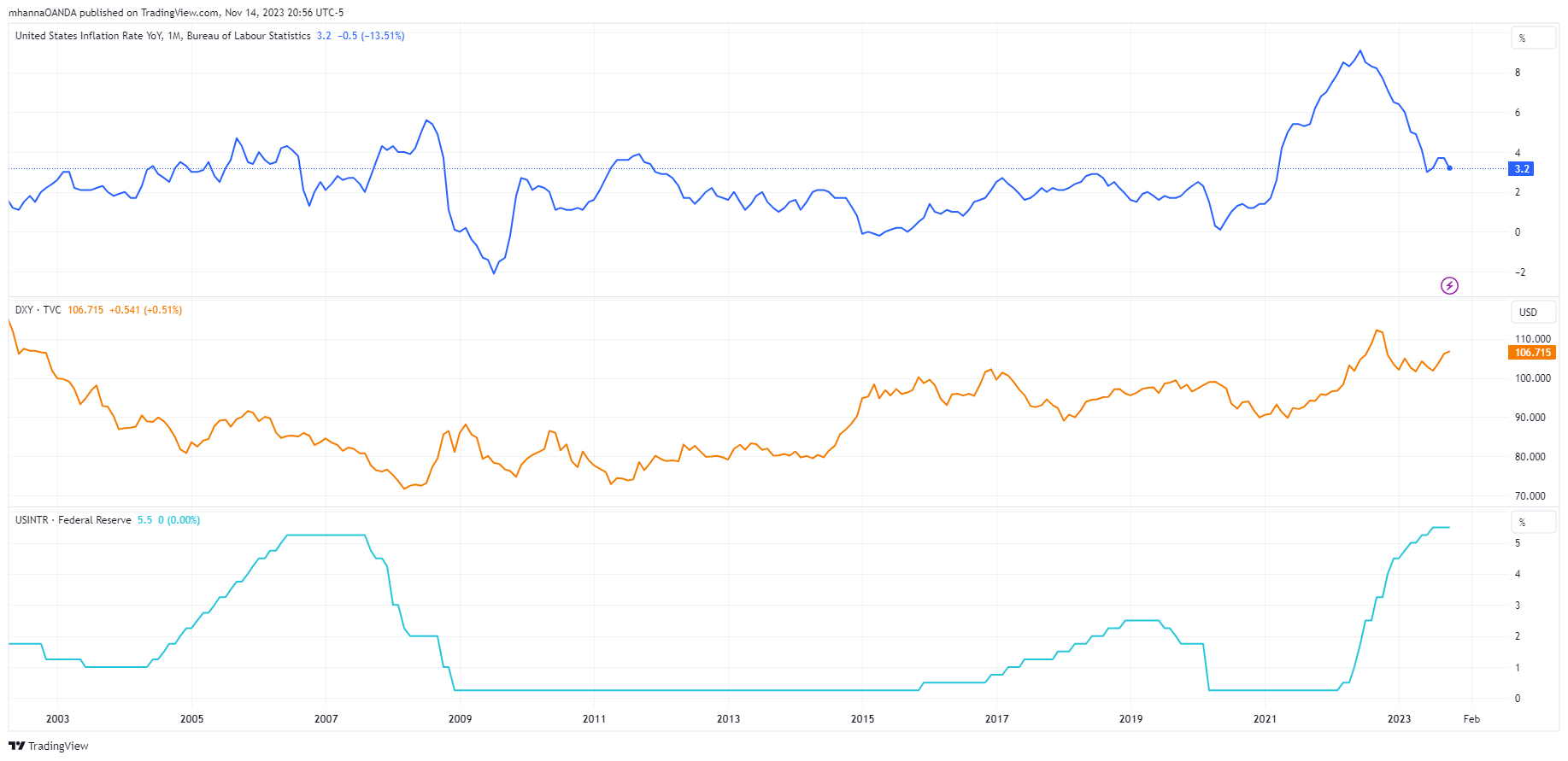

Inflation and interest rates

These are unsurprisingly linked. Central banks have inflation targets that they are mandated to meet. They are generally set by the government and can differ from country to country, although many of the major western economies – US, UK, eurozone, Switzerland etc - aim for annual inflation of around 2%.

If inflation is expected to run hot (i.e. persistently exceed its target), the central bank may respond by raising interest rates. Equally, if inflation is expected to remain persistently below the central banks target, it may respond by cutting interest rates.

In the aftermath of the global financial crisis (GFC), central banks also used quantitative easing (bond buying) as rates had already been cut as low as possible, in some cases negative, and it was hoped that this would achieve a similar goal. Quantitative tightening is the opposite of this and involves allowing bonds to mature without reinvesting the funds or actively selling them, reducing the central bank's balance sheet and in theory tightening financial conditions.

If interest rates rise it can be viewed as positive for the currency as higher rates compared with other countries means higher returns. The opposite is also true.

Find out more about historical central bank and government currency interventions: why and when have they happened?

The economy

If an economy is performing well then demand for the currency may rise, increasing its value compared with currencies of economies that are performing less well.

One reason for this is tied to the section above. If the economy is performing well, unemployment may fall creating a tighter labor market, higher wages, higher demand and more inflation. That is, in theory at least. As we saw in the decade before the pandemic, inflation was hard to come by even with strong economies, high demand and low unemployment.

Another reason why a strong economy can be positive for the currency is that it encourages foreign investment and by extension, demand for the currency.

When countries are performing less well or are in recession, central banks can respond by cutting interest rates and the combination can be negative for the currency. This can be beneficial for some of those using the currency as it can make exports and tourism cheaper, helping the economy to recover. In the aftermath of the GFC there were suspicions of “currency wars” as people questioned whether central banks were intentionally weakening their currencies in an attempt to gain a competitive advantage.

What are the economic data points traders should be aware of?

This differs from one country to the next but a good economic calendar can be useful in breaking down which releases are important for the currencies you are trading.

The importance of the economic releases can also vary over time, depending on the situation. For example, in high inflation environments when central banks are desperately raising interest rates to bring inflation back down to target, there may be a greater focus on measures of wage growth, for example, as central banks may be less inclined to stop hiking while they remain unsustainably high.

During periods of economic decline, survey’s like PMIs can carry more weight as traders look for any indication that the country is seeing signs of recovery. Surveys are forward looking measures and therefore offer more timely indicators of the economy.

Then there’s the data that almost always attract a lot of attention, including inflation, GDP and labor market figures. The US jobs report is one of the most hotly anticipated economic releases every month.

Politics

A stable political environment is widely believed to be a positive for the economy and as a result, the currency. Stable politics means stable conditions, certainty for businesses and investors, and lower risk of significant disruption.

In periods of political instability, a currency may become less attractive as there’s less certainty around the future direction. Political uncertainty can also exist when heading into an election that is expected to be tight between parties that have very different ideologies as the implications for the economy are significant.

Conclusion

The above are just a few examples of factors that may influence the FX markets, the changes in the supply and demand balance leads to currency prices fluctuating against each other. We may also see economic data releases that cause an opposite reaction to what can be expected, this can happen when traders anticipate the upcoming data and place trades ahead of time based on their data release expectations. Read more about the X factors that affect currency value.

Now that you've learned about the most common factors that move currencies, deepen your understanding of forex trading: apply for a demo with OANDA and start your journey now.

Disclaimer

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

It is not investment advice or a solution to buy or sell instruments. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.