Understanding the Fed

The Federal Reserve System, or simply “the Fed” is the central bank for the United States. Congress wrote the Federal Reserve Act after several banking runs in 1907 almost destroyed the banking system. The Fed has five general functions that foster growth and stability for the economy.

- Monetary policy which helps it achieve two mandates created in the 1970s. The first is to promote maximum employment, and the second is for stable prices.

- Keeping the financial system stable by containing systemic risks

- Monitor individual financial institutions and their impact to the financial system

- Assure no disruptions to the plumbing of the financial system by fostering payment and settlement system safety and facilitating US dollar transactions and payments.

- Ensure consumer protections are in place via supervision and examination.

FX traders follow the Fed because changes in monetary policy can have a direct impact on the dollar’s value. FOMC rate decisions, Fed speeches, Regional Fed surveys, and key economic data can all provide some insight to whether the Fed will be easing or tightening monetary policy, which could have an impact on currency values.

FOMC Members

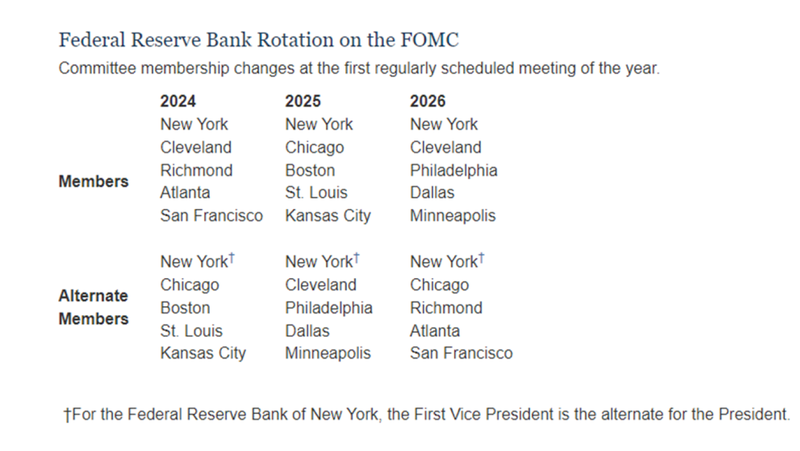

The Federal Open Market Committee (FOMC) is the monetary policymaking body of the Fed. There are 12 FOMC members, with seven members of the Board of Governors and five of the 12 Reserve Bank presidents.

The FOMC holds eight regularly scheduled meetings per year but can have emergency meetings during times of crisis. All 17 central bankers meet during the two-day FOMC decisions, but only 11 get to decide on raising, holding steady or cutting interest rates. The Fed Chair, Vice Chair, and the Board of Governors will get to vote on monetary policy, and the presidents of the other Reserve Banks fill the remaining four voting positions on the FOMC on a rotating basis.

Knowing when the Fed meets and if they are considering a change in monetary policy is important as that market event could provide enhanced trading volatility.

Doves & Hawks

Each FOMC member decides on what they think is the best decision for delivering maximum employment and stable prices for the US economy. If they believe that the economy is overheating and that inflation is too high, they might support raising rates, which would make them a hawk. If the economy needs support, they might vote for cutting rates, which would make them doves. When the Fed makes a decision on rates, they are targeting the federal funds rate, or the interest rate for overnight borrowing for banks.

A Fed official could be a hawk during one cycle and a dove during another one, which makes it important to follow their appearances and track the major economic readings that support their data-dependent approach to monetary policy.

Currency values can experience some heightened volatility when Fed members speak, especially if they adjust their monetary stance. During speeches or interviews, Fed officials have many opportunities to update the public on whether they are leaning towards more dovish or hawkish action before each policy meeting.

The Fed’s Toolbox

The Fed has many tools that can stimulate or cool the economy by changing short-term interest rates. The impact of each policy decision can influence lending, short-term investments, and the plumbing of the financial system.

Reserve Requirements

Depository institutions keep funds in reserve accounts at one of the 12 regional Federal Reserve Banks. The Reserve Requirement makes financial institutions keep a certain amount of reserves against their liabilities, which aims at assuring the ability to pay depositors. Changes to reserve requirements will directly impact how lending or investment will occur for local economies.

Reserve money is applied to process check and electronic payments into the Fed and to support any unexpected cash outflows. Banks that are struggling might opt to borrow emergency reserve funds from a Fed regional bank, which would charge them interest, also known as the discount rate.

Open Market Operations

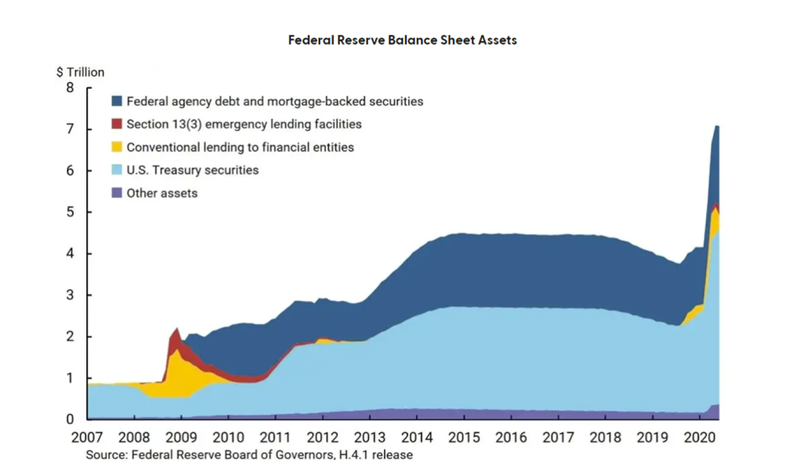

To have an immediate impact in stimulating or cooling the economy, the Fed can also buy and sell government securities in its open market operations. When the Fed becomes a buyer that instantly helps the economy by increasing the flow of money and credit. If the Fed wants to tighten conditions, they can become the seller of securities.

Quantitative Easing

During the Global Financial Crisis, the economy was freezing up and the Fed wanted to encourage lending by performing quantitative easing (QE), which flooded the banks with excess liquidity by buying $600 billion in mortgage-back-securities.

Forex traders might buy or sell the US dollar if they anticipate that the Fed will be adjusting their tools to embrace either an accommodative or tighter monetary policy.

Leading up to an FOMC decision

Fed officials often make appearances leading up to an FOMC decision. They often comment on the state of the economy, and where they stand with monetary policy and defend their economic projections.

The Fed's blackout period starts the second Saturday preceding a Fed meeting and ends the Thursday following a policy decision, unless otherwise noted.

Macro traders oftentimes refrain from excessive positioning leading up to a Fed event if they are unsure how the Fed will be adjusting their economic outlook.

Fed Day

The Fed holds a two-day meeting starting on a Tuesday with the decision coming on Wednesday at 2:00pm EST. The FOMC statement contains a brief synopsis of the economy and justification for their policy decision. Thirty minutes following the FOMC decision the Fed chair holds a press conference that contains a Q&A session with reporters. Wall Street anticipates heightened volatility on Fed days during both the policy decision and following the Fed Chair comments.

Practice your trading strategies with OANDA

Understanding the Fed and what impacts their decisions can help you learn how fundamental traders try to identify swing trading opportunities. OANDA provides a plethora of tools to help you understand what is driving the forex market and multiple platforms to test your various strategies. Apply for a trading account to access all the trading tools and insights.

Disclaimer

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

It is not investment advice or a solution to buy or sell instruments. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.