5 Major Risks of Trading Crypto and How To Minimize Them

Crypto has emerged as an alternative investment class in recent years, with many individuals interested in making money by investing in cryptocurrency. However, crypto markets are highly volatile, which means that while there is potential for financial gain on the one hand, traders are also vulnerable to loss.

In this article, we will explore five risks of trading crypto and how investors can effectively manage these risks when trading cryptocurrencies.

Risk #1: Volatility

One of the most significant risks of trading crypto is the volatility of the market. Cryptocurrency prices can fluctuate significantly in a short period of time.

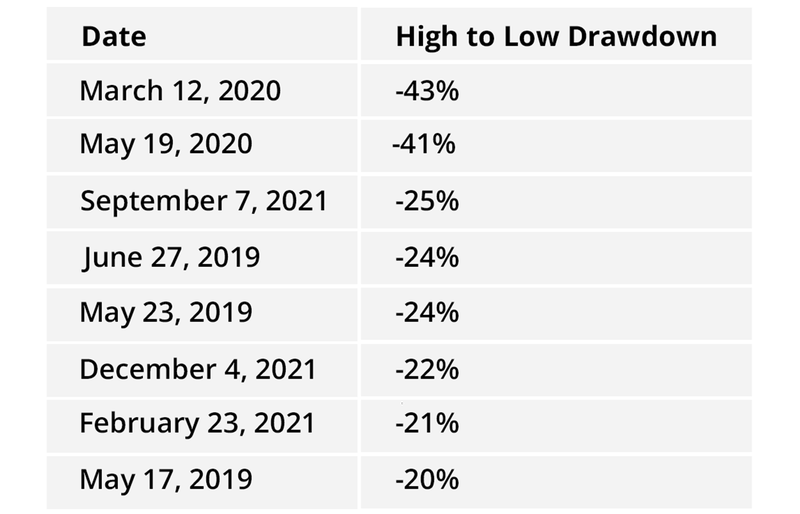

During the three-year period from January 2019 to December 2021, there were 9 days when the total value of the crypto market dropped 20% or more in one day. In fact, the largest losses in crypto occur when risk aversion hits the market.

Largest Daily Drawdown in Crypto Total Market Capitalization

For example, as the COVID pandemic was sweeping across the globe, the total value of spot crypto fell 43% on March 12, 2020, as restrictions were put into place and many economies shut down.

However, volatility works both ways. Shortly after the COVID restrictions were put into place, crypto began to trend higher by over 1600% for the next 14 months. There were 7 days during that trend where the value of crypto rallied 10% or more in a single day.

The best way to overcome volatility is to widen your risk levels on the trade. Traders can continue to use a stop loss; however, the higher volatility in crypto price action should be taken into consideration when deciding on a stop level. Additionally, traders may want to reduce their exposure to minimize the overall risk of the trade.

Risk #2: Liquidity

Liquidity is a lesser-known but stealth risk of crypto trading.

Liquidity is the ability for you to enter and exit your investment without moving the market’s price. You may identify a cryptocurrency project to invest in, but if there aren’t a lot of sellers to match up with your buying size, then the market price has to move higher to attract more sellers.

On the flip side, if you have a large position you are trying to exit, there needs to be enough liquidity to fill your position; otherwise, the price of the cryptocurrency has to fall.

Liquidity in a market ebbs and flows based on the time of day, day of the week, size of the cryptocurrency, and the spot exchange or broker you are trading with.

Liquidity is generally higher for bigger and more popular cryptocurrencies like Bitcoin or Ether. As a result, it is easier to open and close large trades on large-cap cryptos.

On the other hand, smaller-capitalization cryptos and altcoins will have smaller pools of liquidity to draw from. These smaller pools mean the prices may skip around more violently when large orders enter the market.

One popular way to overcome potential liquidity constraints is to break up large trades into multiple traders of smaller sizes. Rather than sending 1 large size into the market, you’ll divide the total trade size into two or three smaller sizes. Then, place each of those smaller trades separately into the market, spaced a few minutes apart. This gives the market time to digest the larger volume of trading.

Secondly, trade with an award-winning broker. When you trade with the award-winning OANDA app, you get easy access to 10 popular cryptos plus over 60 forex pairs.

Risk #3: Scams and Frauds

The cryptocurrency market is largely unregulated. This means there is no government or authority you can turn to after being a victim of cybercrime. The scam could be that you invest in a cryptocurrency project that provides no real service, then the scammer closes the project and the value of your cryptocurrency falls to zero.

Or, hackers may try to steal your cryptocurrency from your digital wallet or even the exchange where you hold the digital assets.

Even crypto exchanges can be subject to fraud.

In November 2022, FTX was one of the largest crypto exchanges, worth billions of dollars. When information was leaked about the potential mismanagement of FTX client funds, a run on FTX began as traders withdrew funds. Within a matter of hours, FTX filed for bankruptcy, and millions of clients were stuck and lost money as they were unable to receive their account capital back.

Investors should take steps to protect their hard-earned capital. If a project promises endless profits and sounds too good to be true, then it could be a scam. Also, research the crypto trading platform and institutions where you are opening accounts. Are they regulated, and what are other clients saying about their experience using them?

Risk #4: Regulatory Risks

Laws and regulations are also subject to change quickly within the crypto market. Since digital assets and cryptocurrencies are a relatively new industry, there is not a regulatory infrastructure in place to determine who will regulate crypto assets or what that regulation might look like.

Governments in various jurisdictions may decide to regulate crypto in different ways. As a result, future regulation could be pivotal to the value of a crypto asset, driving investors to sell and causing the value of the cryptocurrency to fall.

As an example, China has cracked down to ban crypto transactions and mining for its citizens. Chinese officials have publicly noted several reasons for the ban, including consumer protection, capital flights, Yuan devaluation and environmental concerns.

On the other hand, there are countries like El Salvador that have embraced Bitcoin as a means of payment for government or private services.

Lack of regulation might sound ideal for crypto investors, but without regulation, scams and frauds are more prevalent. On the other hand, prudent regulation in developed markets would provide a framework for institutional money to invest in cryptocurrencies.

That institutional money could be the future demand that drives some cryptocurrency prices higher. Regulated crypto trading platforms will have a higher bar to jump over, providing an extra level of security for your funds.

Risk #5: Using the Wrong Broker

To trade crypto securely, investors should use a reputable crypto trading platform that prioritizes security, liquidity, and safe custody.

Platforms with robust security will prevent hackers from stealing funds from your account. Additionally, trading in crypto products that are more liquid will allow you to enter and exit your trades at fair prices. One of the more liquid ways to trade crypto is through spot trading.

What is Spot Trading in Crypto?

Spot crypto refers to buying or selling a cryptocurrency for immediate delivery. In spot trading, traders buy and sell cryptocurrencies at the current market price, allowing for quick trades and immediate access to funds. It is important to note that while spot trading is less complex than other forms of crypto trading, it still carries risks.

Choosing the best crypto spot broker is crucial for trading crypto securely. Investors should look for a spot trading platform that has a good reputation, high liquidity, and low fees. A reputable broker will also prioritize security to protect user accounts.

In conclusion, investing in cryptocurrency carries numerous risks that investors must be aware of. The volatility of the market, liquidity, scams, and regulatory changes are a few cryptocurrency dangers that investors need to prepare for.

Choose OANDA for trading Crypto

Interested in buying and selling popular cryptocurrencies? At OANDA, we know how important trust is when trading crypto. If you feel ready to trade, make a smarter decision: trade crypto with the user-friendly OANDA app, powered by Paxos' regulated blockchain infrastructure*.

So you can get easy access to the most popular cryptos, and also trade forex with an award-winning broker.

You can apply for a demo account at OANDA to determine whether trading cryptos is the right choice for you.

*Everything from Paxos account opening to funding to trading is managed within the OANDA app so investors can seamlessly access major cryptocurrencies such as Bitcoin, Ethereum and PAX Gold against the US dollar from an intuitive platform.

Disclaimer

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO THE NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation. Digital assets held with Paxos are not protected by SIPC. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations