Manage risk with trading performance portal

Determine which parts of your trading strategy are working well and what's holding you back with our suite of risk management tools (powered by Chasing Returns).

Three components, one powerful dashboard

Track risk levels in real time with the risk console. Analyse historical performance with our performance statements and focus on your trading strengths and weaknesses through the performance dashboard.

Find your strengths

- What asset class works best with your strategy?

- What trading sessions are most favourable?

- Is high or low volatility price action better suited to your trading style?

Limit bad trading habits

- What instruments negatively impact your bottom line?

- Are you holding onto trades for too long or too short?

- Is your risk/reward positive or negative?

Improve your strategies

- Monitor and receive alerts on breached risk levels

- Cut out bad habits to mitigate losses

- Focus capital on what is working with your strategy

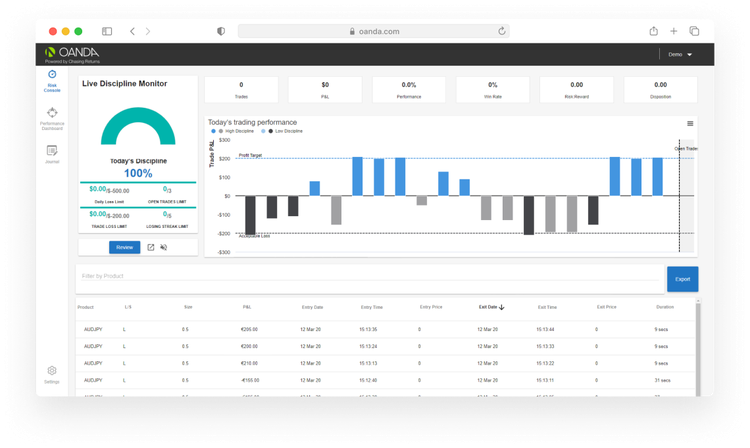

Risk console

Set and track risk levels and receive alerts when a target is hit, or is close to being hit. You can:

- Set acceptable stop loss levels per trade

- Set take profit levels per trade

- Set the maximum acceptable number of open positions

- Set your maximum loss per day across all trades

- Receive alerts when a risk target is approached or breached.

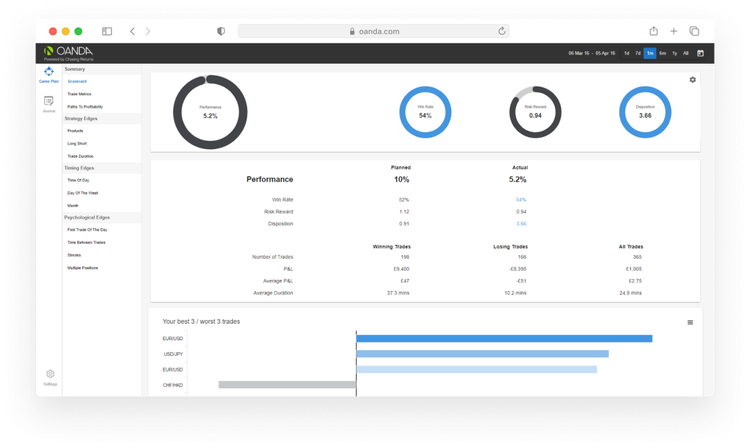

Performance dashboard

The performance dashboard is for post-trade analytics and focuses on three key metrics: win rate, disposition and risk reward. By identifying areas of strength and weakness within your trading strategy, you can see where you can make adjustments by mitigating your negative trading habits, while focusing on your strengths. Through the performance dashboard, you can:

- Visualise, track and manage your trading performance at the click of a button from any OANDA connected platform, including third-party platforms and the OANDA API

- See a breakdown of your trading performance by instrument, overall and average P/L, win rate, risk to reward ratio and more.

- Use strategy edges to determine if your profitability is different based on long or short trades or how long you hold trades.

- Explore timing edges to see if the time of day, day of week, or specific months factor into your trading success.

- Visualise the psychological impact on your trading results with psychological edges. Highlight areas such as multiple positions that can point to over trading.

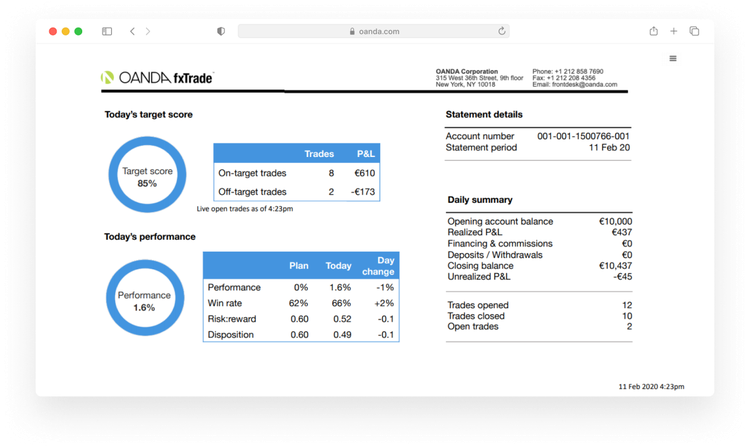

Performance statements

Performance statements combine standard information on your end-of-month statements while including specific performance metrics provided through the performance dashboard. You can export each statement as a PDF for the selected time period, and analyse how your performance changes over time.

- Keep records of your transactions and performance over time

- Review month-over-month performance changes

- Export to PDF for snapshot historical reviews.

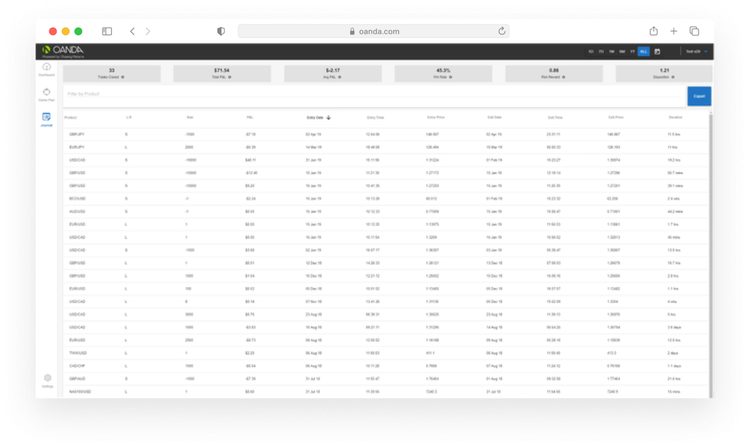

Trading journal

Available through the performance dashboard, you can use the journal to review all your trades as a spreadsheet. Sort and review by category, including:

- Trades that made the most/least amount of money

- This week’s trades only

- Trades based on their duration/products.

Ready to start trading? Open an account in minutes

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Take a position with OANDA Trade

OANDA Trade can be accessed from your web-browser, tablet and mobile device.

Advanced Charting powered by TradingView

Access leading indicators and drawing tools, including trade through charts, 100+ technical indicators and more.

Trade forex on the MT4 platform

Our custom-built bridge combines OANDA’s pricing and execution with MT4’s charting and analysis.