Depth of market

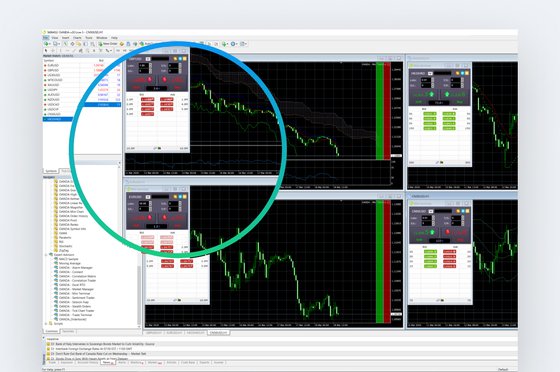

Access tighter spreads on a range of instruments with depth of market (DoM). Depth of market is a native feature of the MT5 platform. On MT4, depth of market is available as part our MT4 premium tools and can be viewed via the mini terminal app.

Benefits of depth of market

- Spreads for typical trade sizes start from just 1 pip on EUR/USD

- Trade large sizes in one transaction

- Transparency of pricing and spread

- See the bid and ask prices for available liquidity

- Place pending orders directly in the depth of market window

- Complete transparency of pricing and spread

Accessing depth of market on MT5

Simply right click on the depth of market symbol in ‘market watch’ and choose 'depth of market.

Accessing depth of market on MT4

Available as part of OANDA premium tools on MT4. Depth of market can be viewed via the mini terminal app by clicking on the spread on the mini terminal order ticket. Note that depth of market is not available on the standard MT4 order ticket or MT4 mobile apps.

When you enter the number of lots on the mini terminal order ticket, the sell and buy prices at the top of the ticket dynamically update to show the entry/closing price and spread for the requested number of lots.

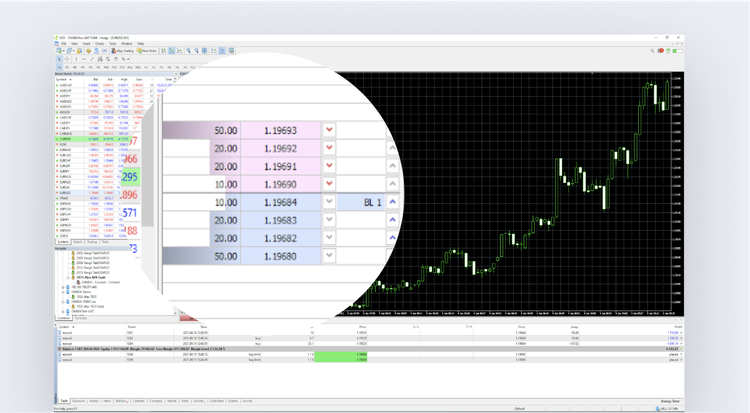

If the requested number of lots is greater than the equivalent volume available on the first level of depth, the system will look down the depth of market to calculate the entry/closing price. After entering a number of lots greater than those available on level 1, the market depth is highlighted according to the number of lots entered.

This will show a list of prices and the number of units available at each price. If you enter an order where the number of units is greater than the number of units available on the first level (we will execute the maximum number of units available at the first level), the next portion of the order’s units over the first level price will be calculated from the subsequent price level.

This could include multiple levels, depending on the size of the order. The range of levels being used will be highlighted by the order ticket.

If the next level’s number of units is still not sufficient to fill the entire order, the process will repeat, filing down the depth of market until the entirety of the order’s number of units has been filled. If the order being submitted is larger than the total number of units available across all the price levels, the order will be rejected.

For example, if there is a first level with 1000 available units and an order for 1100 units is submitted, the first 1000 units of the order will use the first level price, while the remaining 100 units of the order will use the second level price.

This means that the price of an order filling at depth will be calculated as a “Volume Weighted Average Price” (or VWAP), using prices from the depth of market. Each level being used in the calculation will contribute to the order’s price, weighted by the number of units being filled at each level.

Ready to start trading? Open an account in minutes

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Frequently asked questions

Does depth of market apply to all order types?

Yes, depth of market can be applied to all available order types. This includes entry (market, limit and stop) and exit (stop-loss, trailing stop-loss and take-profit) orders.

Which asset classes does depth of market apply to?

The depth of market functionality applies to all asset classes, but the levels of depth will vary across instruments – some may only have one level. You can view the current market depth for an instrument by opening the order ticket and clicking on the Market Depth/DOM window.

How can I calculate a price for an order filled at depth?

Let’s say an order for 10,000 is being submitted. The depth of market window highlights the applicable levels.

- To calculate the resulting Volume Weighted Average Price for this order, first multiply each level’s price by the number of units at that level. Continue down the depth until all of the order quantity has been filled and then sum up the total. In this example, we do not need to use the fifth level, (price 140), as the requested number of units is satisfied from the first four levels.

This results in a notional value of 1,220,000 for the order.

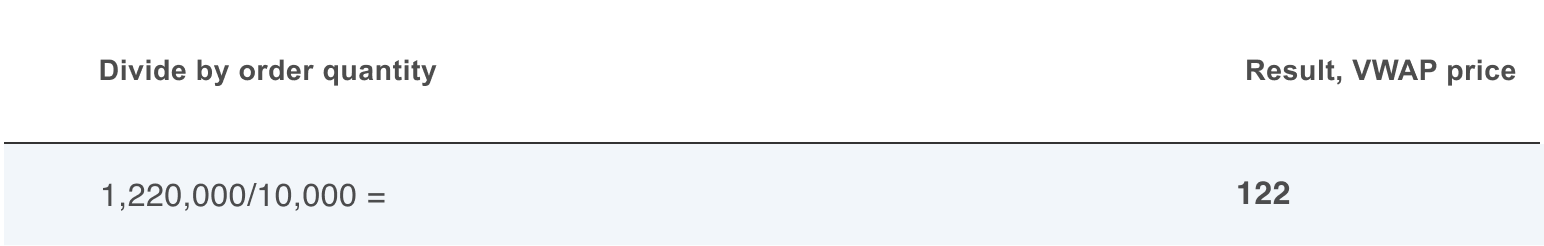

2. Next, divide the notional value by the quantity of units of the order to obtain a VWAP price. In this case, it’s 10,000:

This gives an order “VWAP” price of 122.

Can I break one order into multiple smaller orders?

If multiple orders are triggered at once when the combination of the orders would require executing at depth, the orders are executed on the same basis as if they were combined as one order. So the first order would consume a portion of the depth of market, the second order would carry on from where the first order concluded and so on for each of the orders.