MACD: Finding entry and exit points

The Moving Average Convergence Divergence (MACD) indicator can help traders identify significant changes in momentum and market sentiment, providing insights for entering and exiting a trade.

The Moving Average Convergence Divergence (MACD) indicator can help traders identify significant changes in momentum and market sentiment, providing insights for entering and exiting a trade.

In this article you will learn:

- What Moving Average Convergence Divergence (MACD) is

- Using MACD to build your trading strategy

- Things to consider when using MACD

What is the Moving Average and who invented it?

The MACD indicator (or oscillator) is regarded by thousands of traders around the world as one of the best indicators for identifying trends and reversals. It was invented around 1977 by Gerald Appel, who was looking for a quality indicator that could immediately be interpreted. Appel was searching for an indicator that was easy to maintain and wouldn’t create confusion when looking at a noisy chart.

What is a MACD in trading?

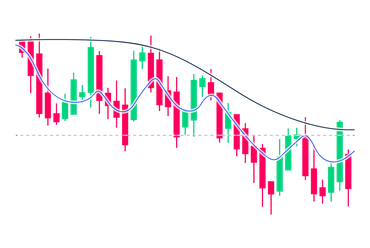

MACD offers a visual representation of the ups and downs in price action as influenced by market volatility. The idea being that, once the indicator has signalled a significant change in market behaviour, turning from bullish to bearish for example or vice versa, you have a potential entry or exit point for your trade.

What is a MACD indicator and what is the theory behind it?

Moving Average Convergence Divergence is classified as a lagging indicator. All of the data used by MACD calculations is based on the historical price action. As a result, it “lags” the price.

How to use a MACD indicator

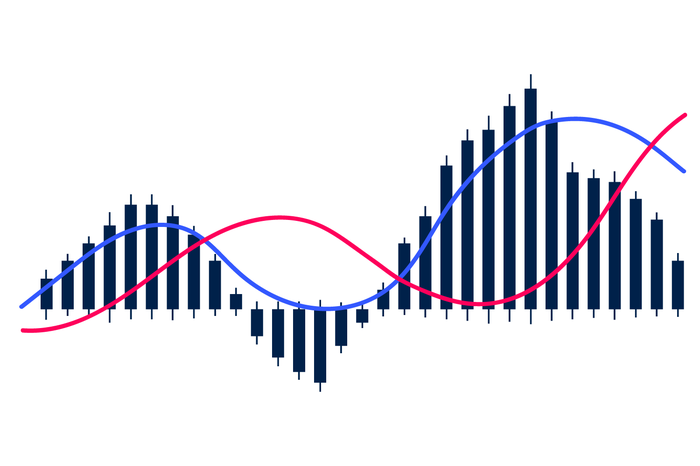

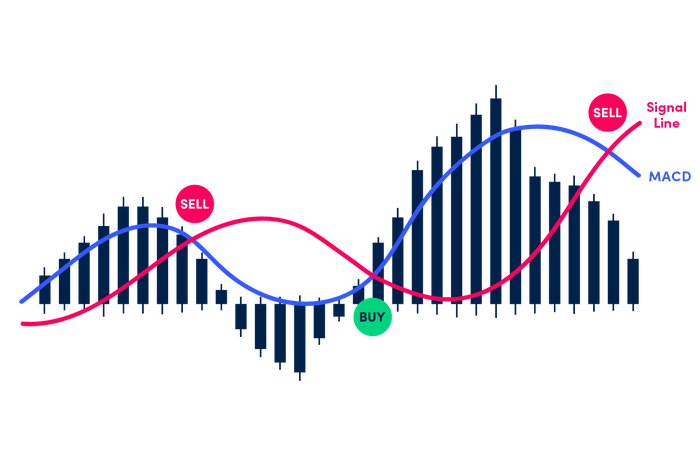

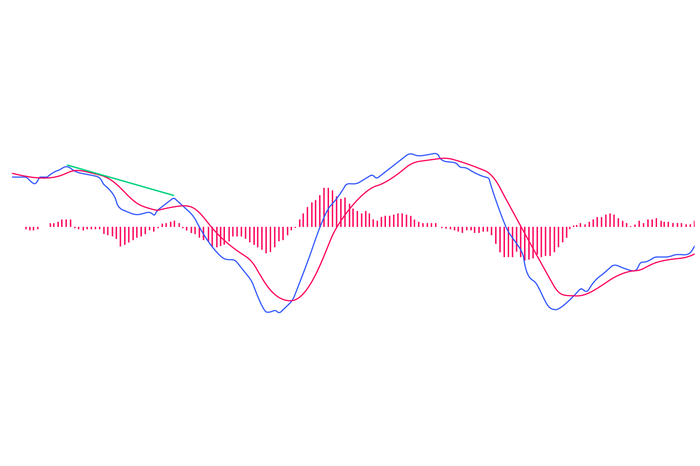

When applying the indicator to your chart, you’ll see two lines running alongside each other and oscillating above and below a zero horizontal line. The MACD line (typically coloured blue) is not just a moving average. It is, in fact, the result of a calculation between two different exponential moving averages.

If you were to use the default settings for the indicator, that calculation would come from subtracting the 12-period exponential average from the 26-period exponential moving average. The second component is the signal line which, for the default settings, is calculated by taking a 9-period exponential moving average of the MACD line itself. Or, put another way, it’s a reading of an average of the last 9 values of the MACD line. This results in the signal line being a slightly slower, more smoothed out version of the MACD line.

The lines on the histogram oscillate around the zero line and that gives the MACD the characteristic of the oscillator.

The MACD provides the histogram placed typically just below a price chart.

This part of the indicator shows you the strength of the price move and can serve as an early warning to get ready for a cue. The deeper or higher the lines, the stronger the move in price.

- When the lines are above the zero horizontal, the market can be said to be bullish, and when they are below, we are in bearish mode.

- When the signal line crosses the MACD line, the indicator is said to be generating a potential buy (above signal line) or sell indication (below signal line).

How to use the MACD to trade

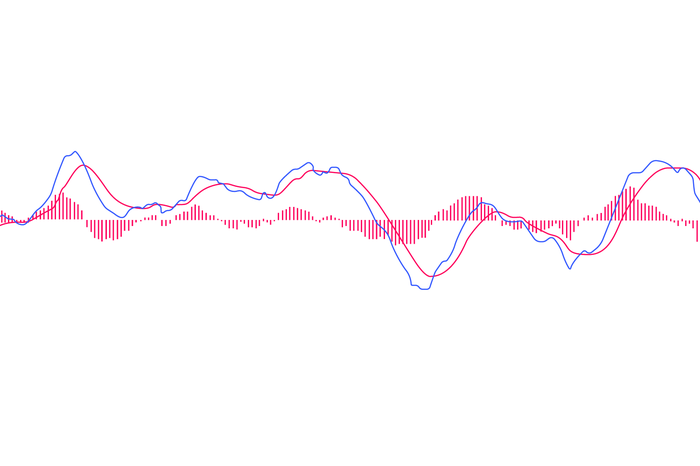

The MACD trading strategy in its most basic form involves using the crossing of the signal line as your entry or exit point for a trade. Although this approach can deliver profitable results in many cases, the MACD’s signal can often fail. This can happen, for instance, when the MACD line and signal line cross over one another multiple times. If you took an entry every time they crossed, you could quickly lose numerous trades in a row. This is why so many traders prefer to combine the MACD with another form of market analysis.

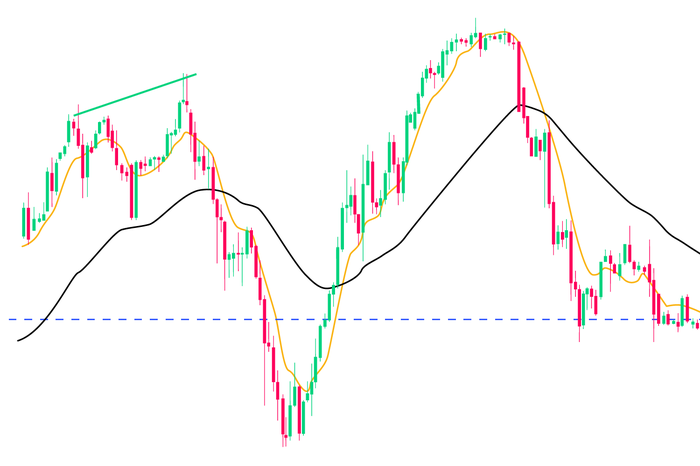

In the example below, we can see how useful it is to map out areas of support and resistance as we consider the validity of the MACD indications. Clearly, when price hits a strong area of support we can be more confident that the MACD’s sign is reliable. If you look at the last move up, you can see the MACD gives us a buy indication, but as the price nears an area of resistance, it flips to the downside. If you hadn’t drawn in the zone of resistance and opened a buy trade, you would have run into a strong, engulfing red candle.

The MACD and divergence

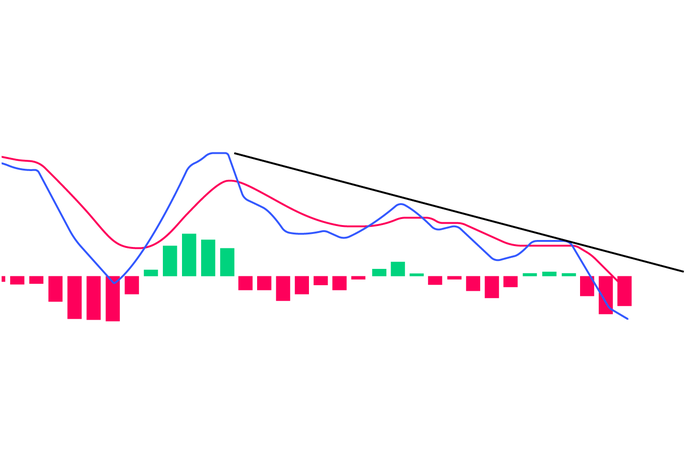

Many traders ignore the price cues created by the crossover and only use the MACD in conjunction with divergence. So what they are looking for is:

- A period of decreasing momentum as price rises, and

- A period of increasing momentum as price falls

How to spot this divergence?

Let’s look at an example. The chart below shows pound sterling in an uptrend against the Japanese yen. To the left of the chart you’ll see a double top forming, where the second top is higher than the first. However, if you look directly below to the MACD, you’ll see momentum is weakening. So even though price is climbing we can see from the divergence between price and momentum that a move to the downside can be anticipated. In fact, shortly after the bears regain control, the red line crosses the blue line and sinks below the horizontal line; price crashes through the 50-period EMA (Exponential Moving Average) and retraces hard.

So we can see that when momentum fails, doubt tends to set in, sometimes rapidly, and the switch in sentiment brings about a reversal. Generally speaking, the higher the timeframe you are looking at, the bigger the reversal.

Three things to bear in mind when using the MACD

Here are some cautionary measures to keep in mind whenever you use the MACD to inform your trading decisions:

Different timeframes and fake signals.

You’ll notice that the MACD can sometimes give a trading indication on a 15-minute chart, which looks dubious at best on a 4-hour chart. By identifying areas of support and resistance prior to following such a cue, you may better establish whether it is reliable or not. You might also like to incorporate moving averages into your strategy so you have further confluence.

MACD settings.

Many professional traders find the default settings (12, 26 and 9) to be too slow, causing late entry and exit to and from a trade. You may want to customise/format the settings and see how well they perform on a demo account. Some alternative settings to try are:

8, 21, 5

3, 17, 5

3, 10, 16

What you’re looking for is to see how close the crossover matches with the reversal on your chart. The best thing to do is to experiment on OANDA’s demo account to find out which settings work best for the instruments you like to trade. Then you can apply them to your live account with greater confidence in your MACD strategy.

Double tops and double bottoms.

These candlestick patterns typically form at the end of a strong push up or down in the market. So, if the price has climbed at speed with little resistance, but then hits an area of resistance and starts to drop, because the move has been made with strong momentum, it is likely that the price will drop only to head back up to retest the area of resistance. The stronger the momentum, either up or down, the less reliable the signal.

Frequently asked questions (FAQ)

Is Moving Average Convergence Divergence a leading or lagging indicator?

The data used in the MACD is based on historical price movement and because of that it always carries out the ‘lag’. This is why MACD is classified as a lagging indicator. On the other hand, some traders prefer using the histogram aspect of MACD to detect when the actual change in trend will occur. In this context, MACD can be considered to be a leading indicator for future changes in trends.

What is the history of MACD and who invented it?

The Moving Average Convergence Divergence indicator was invented by Gerald Appel around 1977 in an attempt to create an easy-to-read indicator.

How to read trends using MACD?

When the MACD line crosses the zero line above, it signals an uptrend, while below indicates a downtrend.

When the MACD line crosses above the signal line, it can be read as an indication to buy, while when it crosses below the signal line, it is an indication to sell.

Key takeaways

- The MACD indicator (or oscillator) is one of the best indicators for identifying trends and reversals in the financial markets.

- The MACD strategy in its most basic form involves using the crossing of the smoothed out signal line over the MACD line as your entry or exit point for a trade.

- The MACD works best when used in conjunction with support and resistance and moving averages as MACD cues often fail, especially in choppy market conditions.

- The MACD is often used purely to identify divergence in the market, when price diverges from momentum, and warns traders of an imminent reversal.

- Many traders find the default settings (12, 26 and 9) to be too slow, causing late entry and exit to and from a trade. You may want to alter the settings and see how well they perform on a demo account.

If you want to learn leveraged trading, explore the variety of training materials available in our learning section. We offer free webinars, workshops and how-to videos. Once you’ve opened an account, live or demo, you can put your knowledge into practice.

Difference between leveraged and other forms of financial trading.

expand_less expand_moreUse fundamental analysis to your advantage.

expand_less expand_moreHow is technical analysis different from fundamental analysis?

expand_less expand_moreHow to build a robust trading strategy using indicators and oscillators.

expand_less expand_more