How to use moving averages

Understanding how moving averages are used in technical analysis can help you trade with greater precision.

Understanding how moving averages are used in technical analysis can help you trade with greater precision.

In this article you will learn:

- The basics of moving averages and identifying and using different types of moving averages

- How to add moving averages to a chart and using different settings

- How to find trend reversals using moving averages

The mean price and moving averages

If you are new to trading and wondering how a moving average works, it is quite simple thanks to our guide to moving averages. As the name would suggest, moving averages (MA) provide traders with a visual representation of an average for the price of an instrument, such as a forex pair, over a certain period of time.

Moving averages smooth out price action to reveal patterns we might otherwise miss on a vanilla price chart. Moving averages can suggest when markets are overbought and oversold relative to the average price of the asset or instrument we are looking to trade. Typically oversold zones offer traders the opportunity to buy (at a discount). Overbought zones offer an opportunity to sell (at a premium). For instance, if we see that GBP/USD is trading below its 50-day moving average on the daily chart, we can assume that this pair, as it is now, is in a bearish phase. If trading above the 50-day moving average, we could say it is still bullish.

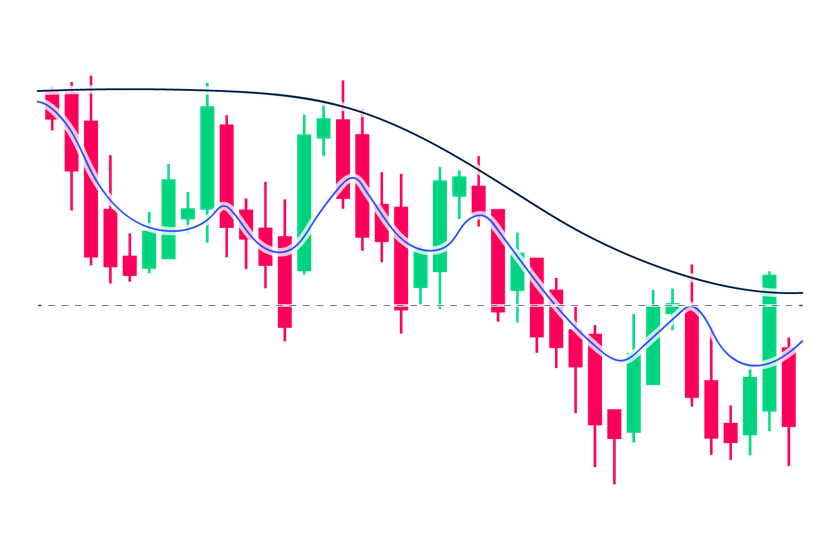

Markets have a tendency to revert to the mean, or average, price. When we add moving averages to a chart, we see prices continually reverting to the mean (mean reversion). This is the market's way of equalising buying and selling action to find the true value for the asset being traded. Every time the price moves away from the moving average, you’ll notice it travels only so far before reverting back to the moving average.

Different types of moving averages explained

All moving averages are lagging indicators, which means they don’t predict new trends, rather, they confirm market trends once they have been formed. They do not predict future price movements.

What are the three most common types of moving averages?

There are three common types of moving averages:

Simple Moving Average (SMA):

The Simple Moving Average (SMA) is the most basic type of moving average and reacts to price movement a little bit slower than the EMA.

Exponential Moving Average (EMA):

For intraday trading, traders tend to prefer to use the Exponential Moving Average (EMA) as it lags less than the SMA and is more responsive to recent price action over shorter periods of time. It is also better suited to breakout trades.

Volume Weighted Moving Average (VWMA):

The Volume Weighted Moving Average (VWMA) combines a measurement of price movement as influenced by trading volume. This indicator places more importance on movements in price owing to spikes or steep drops in volume. In a volatile market the VWMA will be quicker to pick up changes in volume and move more closely to price than the SMA. What this means in practical terms is that the WWMA alerts a trader to a potential breakout sooner than the SMA.

By adding the SMA and VWMA on the same chart and comparing the two, you can get a more accurate picture of price action. For example, if the VWMA is trailing below the SMA in a downward trend, we can infer that there is significant volume pushing price lower. The opposite could be inferred in an upward trend with the VWMA floating above the SMA. The VWMA will also alert you to a reversal a little sooner than a SMA, as you can see in the chart below where the VWMA is represented by the red line.

Settings for moving averages

All three moving averages come with settings for a range of time periods. Typical settings for moving averages:

- Long-term trend: 200 days (200 being roughly the number of trading days in a year)

- Medium-term trend: 50 days (50 being roughly 2 months of trading)

- Short-term trend: 9, 10 and 20 days

Traders typically use 2 or more time periods when planning a strategy.

Short-term traders and high-frequency traders will tend to use even shorter time periods, such as 4 and 6 hours, as they are trading very low timeframes, often as low as one minute.

How to add moving averages to your chart

To add a moving average to your chart, simply click on ‘indicators’ at the top of your chart and select moving average, moving average exponential or volume weighted moving average (VWMA).

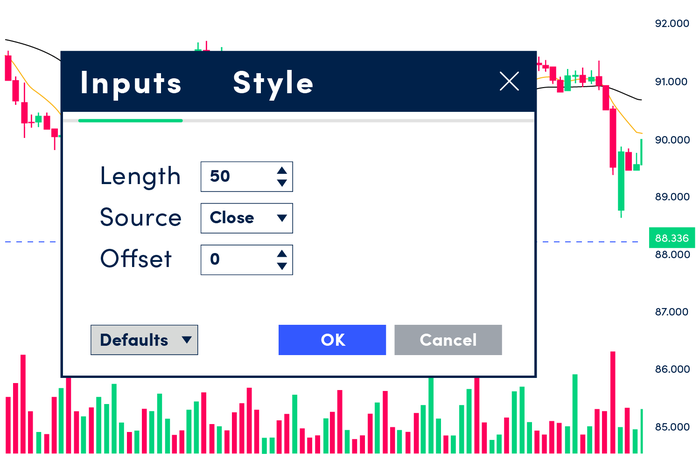

Let’s say you want to add the EMA with settings at 9, 50 and 200 . In this case, you would scroll down to moving average exponential and click 3 times. This gives you 3 variables for EMA. You’ll notice the time value is the same for all 3, so you may want to change 2 of those.

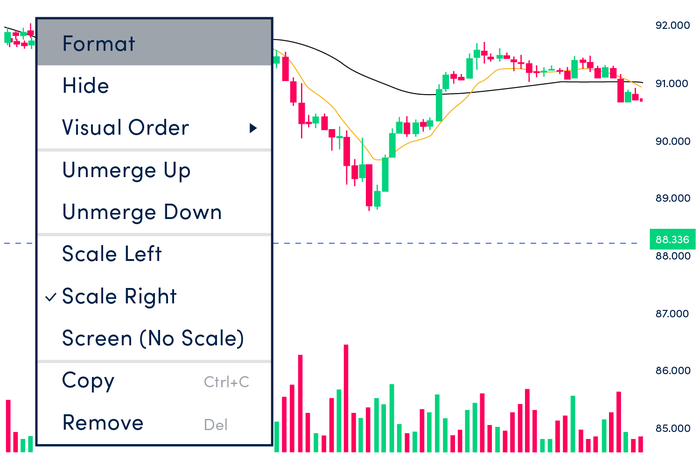

You can do this by selecting EMA > Format. A window will open up, allowing you to customise the settings. Under ‘length’, type in the value for the number of days for the average that you want to add to your chart. So, if the first EMA is 9, you can change the length of the other two EMAs to 50 and 200.

Moving averages and trend reversals

A rising moving average can indicate an uptrend, whereas a declining moving average can indicate the reverse. The higher the timeframe (4-hour, daily and weekly), the better you can identify the direction of the trend (if any).

A bullish crossover, where a short-term MA crosses above a longer-term MA, tends to confirm upward momentum, whereas a short-term MA crossing below a longer-term MA is referred to as a bearish crossover. That said, few experienced traders rely entirely on MAs to get in and out of trades.

A significant percentage of traders and investors prefer to use moving average indicators on their charts. It’s worth noting, though, that MAs are a lagging indicator. This means that the trend may have already reversed by the time reversal signals take shape on your chart.

Many traders also use moving averages as price targets, the equivalent of support and resistance areas. Here is an example using the CAD/JPY currency pair below. On the 4-hour chart, you can see the price is beginning to move lower. With each successive dip, the price climbs back up until it finds a resting place just above the 50 EMA. Price doesn’t make another significant drop lower until it’s broken through the 50 EMA.

If you look at the chart in this graphic, you can see the price hovering just below the 50 EMA. Keeping in mind the pattern just described above, even though the momentum of the retracement is faltering, the experienced trader would likely wait until price has climbed above the 50 EMA before taking a short position for this pair (at around 88.610, which also happens to be an area of resistance). That being said, further confirmation can be sought by checking the daily chart.

Price over-extension in the markets

In an over-extended market, price will move further away from the moving average. If it moves far away enough, it could suggest a potential reversal in the making. A word of caution, however: when the price of an asset is driven by strong momentum, it can remain over-extended for long periods of time. In such circumstances, slight pauses here and there could easily be mistaken for reverals. When you see this kind of action on 1 timeframe and feel tempted to open a trade, it’s a good idea to first check how the moving averages are showing on different timeframes, especially daily and weekly.

In a strong bullish trend market, for example, you might want to wait to see if price breaks through the 50-period EMA not only on the 4-hour and daily charts but also the weekly one. That said, when you see candles moving further away from the moving averages and then begin to move back down (or move up), you might want to consider exiting your trade just in case a reversal is about to gather pace and move hard against you.

Moving averages can be combined with other indicators such as Bollinger Bands® and Stochastics to help add further confirmation to your trading strategies.

Key takeaways

- A moving average (MA) is an indicator that calculates the moving average of an asset to smooth out the price data over a specified period of time by creating a constantly updated average price.

- A simple moving average (SMA) is a calculation that takes the arithmetic mean of a given set of prices over a specific number of days in the past. It helps traders identify trend direction.

- The exponential moving average (EMA) works like the SMA but gives greater importance to the price of an asset over more recent days. Many traders prefer to use EMAs when day trading.

- Moving averages can reveal overbought and oversold areas and serve as support and resistance levels.

- The volume weighted moving average (VWMA) gives an earlier buy or sell signal in a fast-moving market.

Whether you are seeking the perfect indicator or simply looking to enhance your trading strategy, take advantage of our trading education. Our free webinars, workshops and how-to videos offer easy-to-understand information on topics ranging from the basics of trading to advanced strategies. Start putting your knowledge into practice with a live or demo account.

Difference between leveraged and other forms of financial trading.

expand_less expand_moreUse fundamental analysis to your advantage.

expand_less expand_moreHow is technical analysis different from fundamental analysis?

expand_less expand_moreHow to build a robust trading strategy using indicators and oscillators.

expand_less expand_more