Amongst the ranks of top US stock indexes like the S&P 500, Nasdaq, and Dow Jones, the FTSE 100 is perhaps one of the most representative in determining the outlook of the global economy. Read more.

What is the FTSE 100?

The FTSE 100, also known as the Financial Times Stock Exchange 100 index, was created by the FTSE group in 1984 and, in the modern day, ranks amongst the top three stock indexes in Europe, alongside the DAX and CAC.

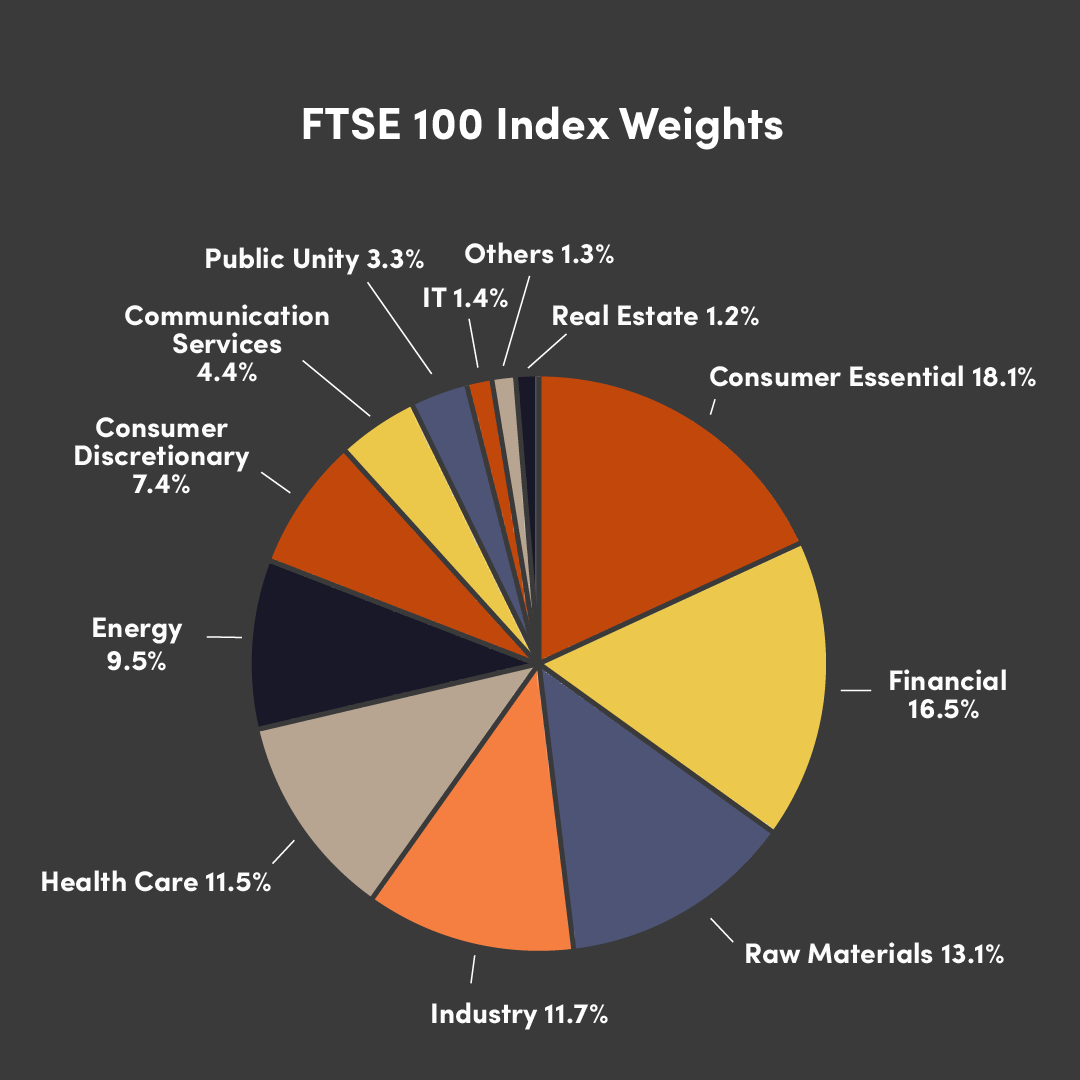

Unlike other examples, which are more country-specific, the FTSE 100 contains stocks of nine European countries: the United Kingdom, Germany, France, Italy, Finland, Switzerland, Sweden, the Netherlands, and Spain, with top companies from the finance, insurance, industry, energy, and healthcare sectors.

Many financial products, such as ETFs and derivative options can be traded on the FTSE 100, which makes the FTSE 100, alongside the S&P 500, Nasdaq and Dow Jones, one of the most representative stock indexes in the world.

How is the value of the FTSE 100 calculated and which stocks are included?

Unlike some indexes, which opt for 'price-weighted', the FTSE 100 uses a ‘capitalization-weighted' method of calculation for determining market value.

To determine which stocks will constitute the FTSE 100, the Financial Times and the London Stock Exchange (LSE) cooperate in selecting the 100 companies with the highest market capitalization, as well as meeting a specified level of daily trading volume to ensure liquidity.

As can be expected, the performance of each constituent stock is closely monitored. The FTSE Russell Group, creators of the index, conduct a review each quarter. If a company’s market capitalization is to reach the top 90, it will be included as a constituent stock and removed if it is to fall below that of the 101st.

Quick Summary:

- The FTSE 100 was launched on the 3rd of January 1984

- It has 100 constituent stocks, typical examples being HSBC, Unilever and British Petroleum

- Its value is determined by ‘capitalization-weighted’ calculations

How can you trade the FTSE 100?

One method of trading the FTSE 100 is by using contracts for difference, or CFDs, which, through the use of leverage, allow investors to trade with a small amount of funding. If price is expected to rise, traders can take a long CFD position and a short CFD position if price is expected to fall, making CFDs a good option for both long and short trading.

What are the benefits of CFD trading?

- Leverage: When compared to other options, CFDs offer a larger amount of leverage, meaning that you can trade with a relatively small amount of funding while still participating in the ups and downs of the market.

- Two-way trading: While trading with CFDs, you're able to profit from prices going up or down by buying and selling, respectively.

- More ways to earn a return: In some scenarios, when holding a CFD position overnight, traders can earn interest.

With over 25 years of history, OANDA is the world's leading CFD broker and offers CFD trading on the Russell 2000

OANDA holds six regulatory licenses worldwide and is proud to be one of the most secure Forex brokers in the world:

- UK Financial Conduct Authority

- US Commodity Futures Trading Commission

- Canadian Investment Industry Regulatory Organization

- Australian Securities and Investments Commission

- Japan Financial Services Agency

- Monetary Authority of Singapore

Why should you trade with OANDA?

OANDA offers CFDs on most of the world’s key indices, including the top three US stock indices, the UK’s FTSE 100, the German DAX 30, and the French CAC 40.

Here are the reasons why you should trade with OANDA:

- OANDA offers unique indicators and Expert Advisors (EAs)

OANDA offers dozens of unique technical indicators and EAs for beginners and professional traders. The OANDA Japan team develops these indicators and EAs, available to investors in Japan, Taiwan, and around the globe. - OANDA offers over 60 CFDs

OANDA offers quotes for CFDs on indices, currency pairs, commodities, and precious metals. Our spreads average 0.5 – 0.8 on the S&P 500, 2.7 – 3.2 on the Nasdaq, and 3.0 – 3.5 on the Dow Jones. We also offer very competitive spreads for other products. - Trade at home and on the go

You can trade with MetaTrader 4 or MetaTrader 5 for desktop or via the MT5 mobile app on your phone or tablet.