What is leverage trading?

Leverage trading is the use of a smaller amount of initial funds or capital to gain exposure to larger trade positions in an underlying asset or financial instrument.

Leverage trading is the use of a smaller amount of initial funds or capital to gain exposure to larger trade positions in an underlying asset or financial instrument.

Learn trading basics

In this article you will learn:

- What is leverage trading?

- What are maximum leverage ratios?

- The history of trading with leverage

What is leverage trading?

Leverage trading is the use of a smaller amount of initial funds or capital to gain exposure to larger trade positions in the underlying asset or financial instrument, which can include forex (currency), commodities, and indices.

As a trader, you are looking to make a profit on the difference between the open price and closing price of your trade.

Without leverage, assuming you wanted to invest US$100 into buying EUR/USD, if the price moved in your favour by 1%, you would hold US$101. Similarly, if the price decreased by 1%, you would hold US$99.

How does leverage trading work?

Leverage allows you to use a smaller amount of initial funds or capital to gain exposure to larger trade positions in an underlying asset or financial instrument. When you open a live account with OANDA, for every trade you place with leverage, you are able to gain increased exposure to an underlying asset or financial instrument that is of interest to you. Put simply, leverage effectively amplifies the amount of money you are putting down to trade with.

For example, if you decide to use leverage when trading stocks or shares, you can buy an increased amount of shares. So, with a leverage of 10:1, your money is amplified 10 times, if it is 30:1, then your exposure is amplified by 30 times, and so on. The use of leverage can also be applied to other types of financial instruments, such as forex and indices. However, the flip side of trading with leverage is that, if the trade goes against you, your losses will be amplified as well. In other words, greater exposure leads to bigger ups and bigger downs.

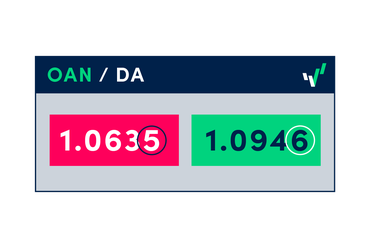

Leverage ratios

Regulators across the globe set maximum leverage limits to help retail traders avoid excess risk. At OANDA, we publish current leverage rates on our website.

The history of leverage

The current use of the word leverage in the financial context can be traced back to 1933.

Leveraged trading is often associated with new technologies such as the internet and mobile trading platforms, but trading with leverage has been around for quite some time. This type of trading has been common in the United States since the early 20th century. At that time, the requirements around trading were not so defined and the market was not regulated.

Consequently, extremely high leverage ratios were often allowed. As much as this might have helped some to achieve great profits, plenty of traders often received margin calls ﹣ an alert notification telling traders that their account balance had gone below the amount needed to keep their positions open﹣causing heavy losses.

Over time, leveraged trading became more and more regulated as regulators around the globe started enforcing measures to protect customers, especially retail clients. Regulators have introduced margin requirements and maximum leverage limits in their jurisdictions and require brokers to provide risk disclosures to customers so that customers are informed about the risk that trading with leverage carries.

Key takeaways

- Leverage trading isn’t new. It has been in existence for a century.

- Trading with leverage carries risk and can lead to big wins as well as big losses.

- In recent years, regulators across the globe have been taking action to minimise risk for retail customers by introducing maximum leverage ratios, as well as enforcing specific risk management measures.

- Different markets, asset classes and financial products can be traded with leverage.

Frequently asked questions (FAQ)

Is leverage trading risky?

Yes, trading on leverage carries a high degree of risk. You may sustain a total loss of the initial funds and any additional funds deposited to maintain your position. If the market moves against your position, you may be called upon to pay substantial additional funds on short notice in order to maintain your position. If you fail to comply with a request for additional funds within the specified time, your position may be liquidated at a loss and you will be liable for any resulting deficit in your account.

What happens when trading with leverage?

Leverage is a trading mechanism which can be used to increase the exposure to an asset class or financial instrument by allowing you to open larger positions than the actual capital you have placed into the trade position. The amount of capital you have to put into a trade depends on the leverage ratio for the specific financial instruments traded. The remaining part of the amount is effectively temporarily ‘covered’ by the broker.

When the price moves, the same amount of leverage is then used to determine the profit or loss. A relatively small market movement will have a disproportionately larger impact on the funds you have deposited or will have to deposit; this may work against you as well as for you.

Does leverage affect the size of a trade?

Leverage itself does not have an effect on trade size, however, the higher the leverage, the larger the exposure to the underlying asset. In other words, with higher leverage you can buy or sell more units (lots) of the instrument you wish to trade and use less margin in order to place the trade. The size of the position determines the notional value of the trade or the exposure you have in the underlying asset or financial instrument.

In order to trade effectively with leverage, you need to be aware of the risks and benefits and this starts with a solid education. Our webinars, workshops and how-to videos can help you learn the basics of leverage trading for free. Once you’ve opened a live or demo account, you can start implementing some of the trading strategies covered in our learn section.

Difference between leveraged and other forms of financial trading.

expand_less expand_moreUse fundamental analysis to your advantage.

expand_less expand_moreHow is technical analysis different from fundamental analysis?

expand_less expand_moreHow to build a robust trading strategy using indicators and oscillators.

expand_less expand_more