What is margin in leverage trading?

Leverage the funds in your account to potentially generate larger profits or losses while trading.

Leverage the funds in your account to potentially generate larger profits or losses while trading.

In this article you will learn:

- What is margin and how can I leverage margin on my account?

- The risks associated with margin trading

- What are margin requirements, margin calls and margin closeouts?

Leverage and margin in trading

When exploring this subject, it is important to remember it is not about margin vs leverage, as these two elements work together. Leverage allows you to trade a larger financial position with a smaller sum. Margin, on the other hand, is the initial investment you need to make to open a leveraged trade. Combined, margin and leverage allow you to leverage the funds in your account to potentially generate larger profits than your initial investment.

The flipside to trading with margin is that you can also potentially incur significant losses if the market moves against you. At OANDA, leverage or margin trading enables you to open positions that are larger than your account balance.

To minimise your losses and reduce the negative effect of leverage on a losing trade, it may be a good idea to use a stop loss.

What are leverage and margin?

When you deposit money in your trading account, the money you have deposited can be used as available margin. This margin can be used to open your trades ﹣ you will be able to open trades by putting down a fraction of the full value of your trade.

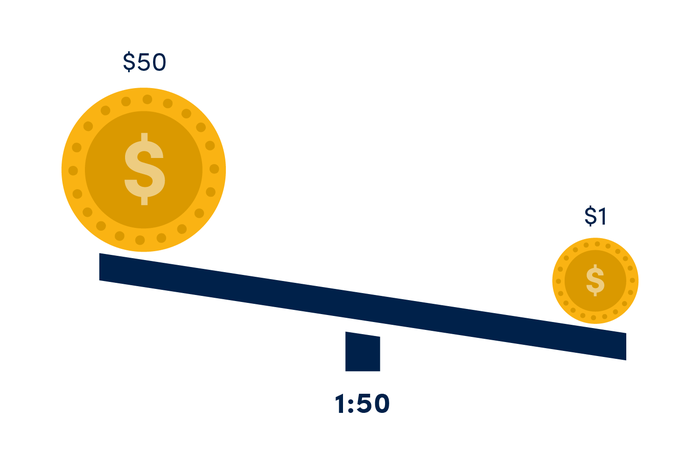

Leverage is described as a ratio or multiple. So, for example, trading using leverage of 30:1 means that for every $1 of available margin that you have in your account, you can place a trade worth up to $30. For instance, say you are looking to open a position on a forex pair. Using leverage of 30:1, for every$100 you have in your account, you can place a trade worth up to$3000 and so on.

In other words, margin is the amount of money needed to open a position, while leverage means that you can enter into positions larger than your account balance.

How does trading with margin work?

When asking how does margin work, the most important factor to remember is that trading with margin and leverage allows you to place trades that would otherwise be unavailable to you. Once you understand how leveraged trading works, it can be a powerful tool to maximise your profits: with just a fraction of the value of your trade, you can have the same impact as a conventional trade. On the other hand, trading with leverage could also result in significant, rapid losses to your capital. This makes buying on margin a high-risk, high-reward method of trading.

Any price increase in your favour at the time of closing your trade is multiplied by the leverage you are working with. Remember, however, that leveraged trading is a double-edged sword. If the market moves in the opposite direction of your trade, you could just as easily rack up losses. You can manage your trading risk by placing a stop-loss order on your trades.

Understanding margin requirements, margin calls and margin closeouts

How to calculate margin

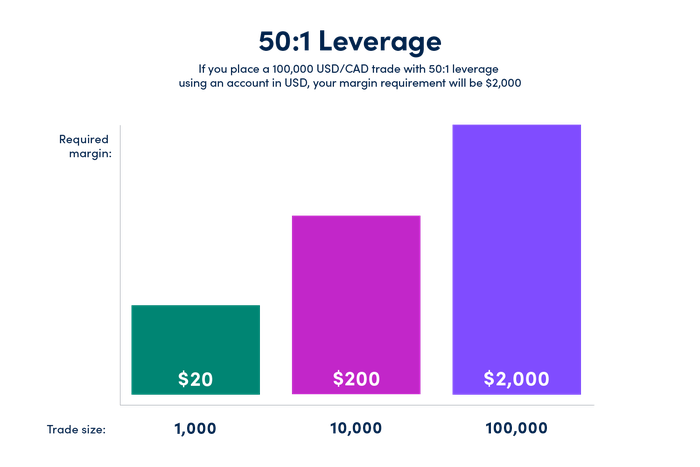

The margin needed to open each trade is derived from the leverage limit associated with the instrument that you wish to trade. For example, if your leverage is 30:1, you would need a margin of 3.33% (1/30 x 100) of the position value you wish to open. Having your account in US dollars, this would mean that with a leverage of 30:1, you could open a $30 trade for each euro/dollar available in your account.

Let’s look at a simple forex example. You’re thinking of opening a long position of 5,000 units of USD/CAD and your account is in Canadian dollars. As the leverage is 50:1, the margin needed to open this position is 2% of 5,000 =

~135.77 CAD.

If the instrument you are trading has a different base currency to your account currency, then your margin will be calculated in the base currency and converted to your account currency at the prevailing exchange rate.

Margin requirements

In order to keep a position open, you will need to maintain a minimum amount of money in your account. This is known as margin requirement. On our proprietary platforms, our margin close out slider-bar illustrates your margin used, if the speedometer is above 50%, your account is no longer meeting the minimum margin required for your open positions.

When preparing to open a new trade, experienced traders prefer to calculate not just where to exit if the trade goes in their favour, but also how much loss they are willing to risk. So, say you’re going long on a currency pair and looking up on the chart, don’t forget to look down too to estimate your losses, and vice versa if you take a short position.

The same is applicable to how much of your funds you would like to engage into your trades. As much, theoretically, gains might seem unlimited, you should bear in mind that losses can also be significant. The more of your account funds you use as margin, the greater your risk of margin closeout. You should also mind the number of trades you have running at any one time. Having too many positions open may lead to greater exposure, or if these positions are related (all to U.S. Dollar for instance), a risk of price swing on these would be n-times the number of open positions.

Margin calls

Margin calls are an important aspect of leveraged trading. If the Net Asset Value (NAV) of your account falls to a level that is below the minimum regulatory margin requirement, a margin call will be triggered. If this happens, we may message you to ask you to deposit more funds into your account to maintain your positions, or close open positions to lift your account balance above the minimum margin requirement.

However, there might be circumstances where we are unable to message you about a margin call; in a fast-moving market there may be little time between warnings, or there may not be sufficient time to warn you at all. It is your responsibility to monitor your open positions and ensure sufficient funds are held to cover the margin requirement.

What is a margin closeout?

If for any reason you don’t take either of the steps just described and you do not have sufficient funds on your account to maintain your positions, your positions will undergo margin closeout, resulting in the closure of all of your open positions.

Be mindful of the “margin closeout percent” field in the account summary of the trading platform. The closer the margin closeout percent is to 100%, the closer you are to a margin closeout.

Although it may at first seem like a penalty, a margin call is essentially a warning that you need to temper your risk level and attend to losses that could exceed your accepted risk level. Ultimately, you are responsible for monitoring your account to prevent margin calls and margin closeouts from happening. By limiting your trade size and working with stop losses, you can better maintain sufficient margin in your account to support your open positions.

Tips for avoiding margin calls

- Check your positions regularly.

- Never leverage your entire account balance.

- Deposit additional funds into your account when your available margin becomes low.

- Reduce the margin requirement by closing some open positions.

- Close individual positions.

- Use risk management measures such as stop losses.

- Be mindful of gap ups and gap downs, with sudden hikes or drops in price, as these could trigger a margin call if you have neglected to use stop losses.

FAQs

What is position sizing in forex?

Position sizing is simply a way of determining how many units you should trade according to your desired level of risk.

What is Net Asset Value (NAV)?

The NAV represents the current value of your trading account, including your unrealised profits or losses (P/L).

How to calculate your available funds

Your available funds are equal to that part of your account’s Net Asset Value that is not being used as margin requirement to maintain open positions. These funds are free to use to open another position, transfer to another sub-account or withdraw. You can find this figure in the ‘Margin Available’ field in the Account Summary section of your trading dashboard on the OANDA trading platform.

So let’s say your account balance is $550 and your unrealised P/L is -$45. Your account’s NAV is $550 – $45 = $505. And let’s say you have two open positions with a cumulative margin requirement of $300. Your margin available would be $505 (NAV) – $300 (margin requirement) = $205. In this scenario, you would be able to open a new position if the margin needed to open that position was less than $205.

How to determine when a margin closeout may occur

If your Margin Closeout Value (MCV) falls to less than half of the margin used to open your positions, some or all of your open positions will be automatically closed using the current OANDA trading rates at the time of closing. If trading is unavailable for certain open positions at the time of the margin closeout, those positions will remain open and the platform will continue to monitor your margin requirements. When the markets reopen for the remaining open positions, another margin closeout may occur if your account remains under-margined.

The Margin Closeout Value is equal to your balance plus your unrealised P/L from all open positions, converted into the currency of the account, and calculated using the current midpoint rates. This value is approximately equal to your NAV, but with slight deviations due to being calculated based on midpoint rates rather than bid/ask rates.

For example, let’s say you have one open long position in 10,000 units of USD/ZAR and your account is in USD. You are trading this instrument with a leverage of 20:1. The margin needed to open your position was 5% of $10,000 = $500. So, the margin required to maintain your open position is 0.5 ($500) = $250. When your account’s NAV falls to $250 or below, you will get a margin closeout.

On the OANDA trading platform your ‘margin used’ bar will indicate how close you are to a margin closeout; when you hit 100% margin utilization, your account will trigger a margin closeout.

If you want to trade with leverage, you need a good trading education - from the basics of what a ‘pip’ is, to how to use technical indicators and more. Once you’ve opened a live or demo account, you can start implementing some of the trading strategies covered in our learn section.

Difference between leveraged and other forms of financial trading.

expand_less expand_moreUse fundamental analysis to your advantage.

expand_less expand_moreHow is technical analysis different from fundamental analysis?

expand_less expand_moreHow to build a robust trading strategy using indicators and oscillators.

expand_less expand_more